Abstract:

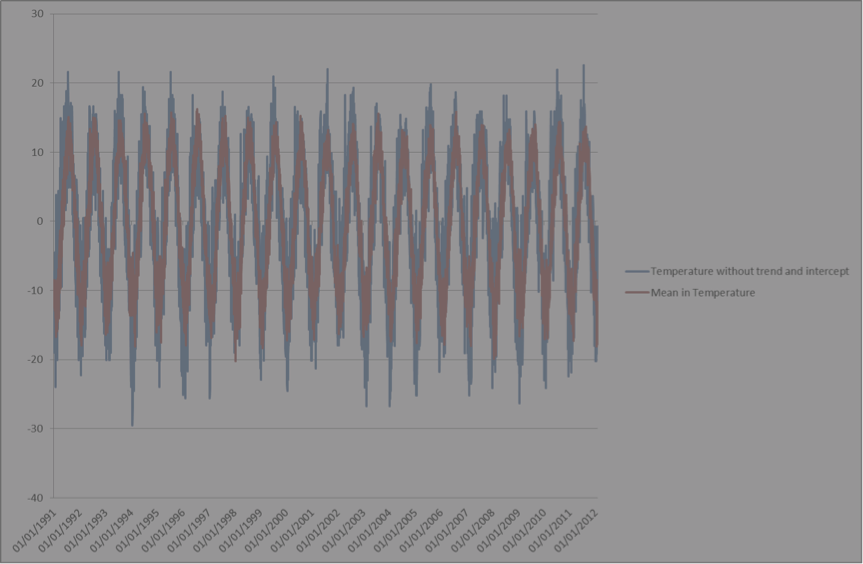

We explore the returns of the frozen concentrated orange juice (FCOJ) future prices and the dependency with the temperature variation in the city where the exchanged is based (New York) . Intuitively, one could consider that when temperatures are higher (resp. lower) than the average seasonal temperature, the consumption of orange juice increase (resp. decrease).. We do not search here an weather index that will account for the real consumption weighted by each regions temperature and number of potential consumers, but most likely the impact thorough a behavioural effect. In fact it is well known that the liquidity on futures market is mainly driven by speculators that use anticipations in the underlying physical market in order to provide with exceeding risk adjusted return. Psychologically FCOJ is apprehended as a weather market and we prove that this apprehension implies a weather linked patter in FCOJ returns. Working on both the demand effect and behavioural influence of weather, we explore dependence between the return of the orange juice price and the variation in temperature. As an application we present an alpha providing investment strategy based on long/short positions on the front month FCOJ futures depending on the temperature anticipations.

We explore the returns of the frozen concentrated orange juice (FCOJ) future prices and the dependency with the temperature variation in the city where the exchanged is based (New York) . Intuitively, one could consider that when temperatures are higher (resp. lower) than the average seasonal temperature, the consumption of orange juice increase (resp. decrease).. We do not search here an weather index that will account for the real consumption weighted by each regions temperature and number of potential consumers, but most likely the impact thorough a behavioural effect. In fact it is well known that the liquidity on futures market is mainly driven by speculators that use anticipations in the underlying physical market in order to provide with exceeding risk adjusted return. Psychologically FCOJ is apprehended as a weather market and we prove that this apprehension implies a weather linked patter in FCOJ returns. Working on both the demand effect and behavioural influence of weather, we explore dependence between the return of the orange juice price and the variation in temperature. As an application we present an alpha providing investment strategy based on long/short positions on the front month FCOJ futures depending on the temperature anticipations.

Keywords:

- Weather variables

- Temperature

- Orange juice futures

That’s because California growers, who normally sell most of their orange crop as fresh fruit, may be prompted to squeeze juice from their damaged fruit, adding to an already ample world-wide supply. Also, juice prices rose sharply earlier this year in response to bad weather and wildfires in Florida but lately have been trending lower.

Thanks for the info!